You've reached the limit for free Overall Ranking scores. For more information, request a demo.

See CSRHub in Action

You have a total of 10 free searches available.

Corporate Social Responsibility (CSR) & Environment, Social, Governance (ESG) Metrics

Bonavista Energy Corporation ESG Ranking

ESG Ranking (%)

?

5

Sources

?

No Special Issues

Affect This Company

?

5

Sources

?

No Special Issues

Affect This Company

?

Bonavista Energy Trust is a Calgary-based oil and gas royalty trust created through the reorganization of Bonavista Petroleum Ltd. in July 2003. Bonavista Energy Trust is one of North America's largest energy trusts, with a market capitalization of approximately $2.7 billion CDN as of September 1, 2009. The company’s base of operations is geographically focused within Alberta, Saskatchewan and North Eastern British Columbia. Production for 2009 is expected to average approximately 55,500 - 56,000 BOE per day, consisting of 61% natural gas and 39% oil and liquids.

Bonavista Energy Trust Converted Into Bonavista Energy Corporation

Who Uses CSRHub and How

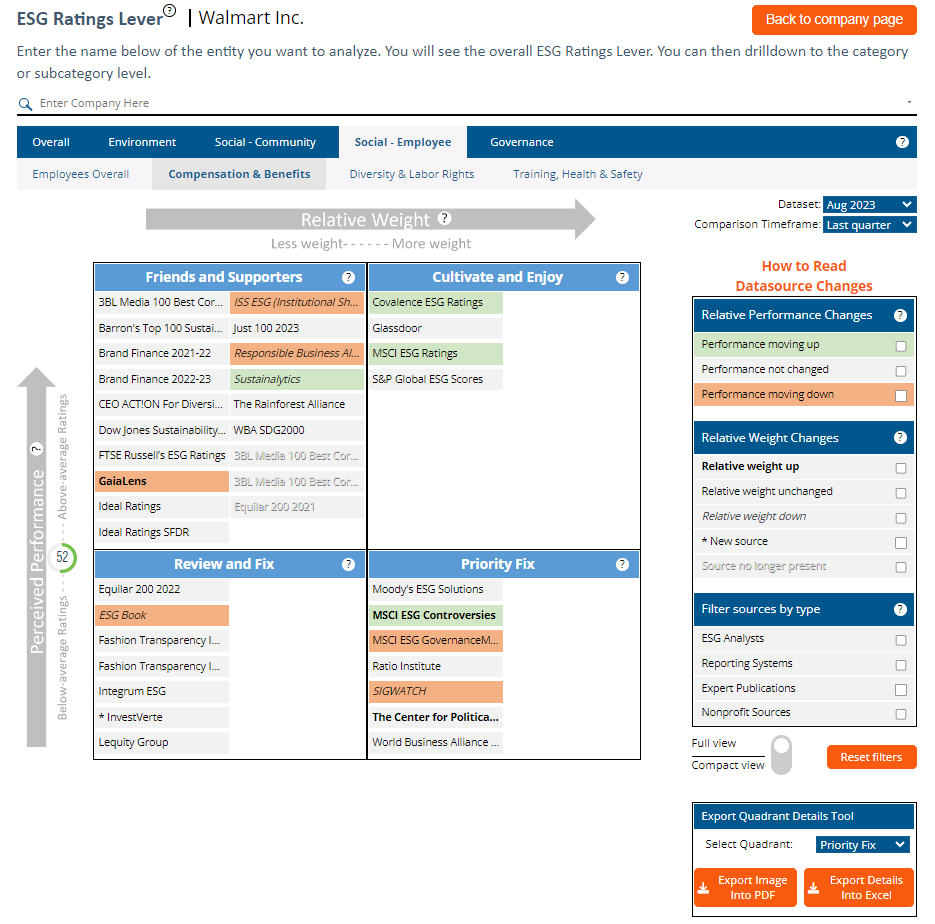

Companies face a complex ESG landscape with many raters and little coherence.

Corporate Managers

Benchmark against your peers

Improve stakeholder communication

Pinpoint ESG reporting gaps

Review your supply chain

Uncover ESG business opportunities

Consultants

Expand your ESG expertise

Find and focus on the best reporting strategy

Propose innovations and drive change

Communicate with all levels of management

Build client ESG knowledge

Supply Chain Professionals

Rapidly review your supply chain

Proactively identify and address risk

Assess and improve supplier performance

Access easy-to-use tools to fit into your management system

Investment Professionals

Screen your investment universe

Back test to find material ESG indicators

Share your ESG strategy with clients

Engage with companies

Improve asset owner reporting

CSRHub includes data on World Economic Forum, Green bonds, ESG ratings, investment advisor, return on social investing, and Employees.

See Your Roadmap for

with the new CSRHub ESG Ratings Lever below

We Harmonize Global ESG Data

Your title or message

Sources

{{sources_count}}

for

Companies

{{companies_count}}

in

Countries

{{countries_count}}

Your title or message

Prev

Next

Summary of the data sources currently reporting on Bonavista Energy Corporation and some examples

ESG

{{ esgAnalystsDatasources.length }}

Reporting

{{reportingSystemsDatasources.length}}

Expert

{{ expertPublicationDatasources.length }}

Nonprofit

{{nonprofitDatasources.length }}

How to Get Our Data

Website Browsing

Excel Dashboards

-->

RESTful API

Distributors and Integrators

Explore Your Options

Schedule a consultation with a CSRHub team member to

explore your use case and discuss a tailored solution.

Name Variants for Bonavista Energy Corporation