You've reached the limit for free Overall Ranking scores. For more information, request a demo.

See CSRHub in Action

You have a total of 10 free searches available.

Corporate Social Responsibility (CSR) & Environment, Social, Governance (ESG) Metrics

JP Morgan Chase & Co. ESG Ranking

|

|

ESG Ranking (%)

Compared With

36,822 Companies

|

?

89

Sources

for this company

?

2 Special Issues

Affect This Company

?

89

Sources

for this company

?

2 Special Issues

Affect This Company

?

ESG Ranking History

Industry average is for the

2135

companies in

Banking industry

Offers commercial, consumer and investment banking services to its clients

Who Uses CSRHub and How

Companies face a complex ESG landscape with many raters and little coherence.

CSRHub’s data and tools solve these problems.

Corporate Managers

-

Benchmark against your peers

-

Improve stakeholder communication

-

Pinpoint ESG reporting gaps

-

Review your supply chain

-

Uncover ESG business opportunities

Consultants

-

Expand your ESG expertise

-

Find and focus on the best reporting strategy

-

Propose innovations and drive change

-

Communicate with all levels of management

-

Build client ESG knowledge

Supply Chain Professionals

-

Rapidly review your supply chain

-

Proactively identify and address risk

-

Assess and improve supplier performance

-

Access easy-to-use tools to fit into your management system

Investment Professionals

-

Screen your investment universe

-

Back test to find material ESG indicators

-

Share your ESG strategy with clients

-

Engage with companies

-

Improve asset owner reporting

CSRHub includes data on environmental problems, Governance, Training, Health & Safety, CSR, Compensation & Benefits, and investment strategies.

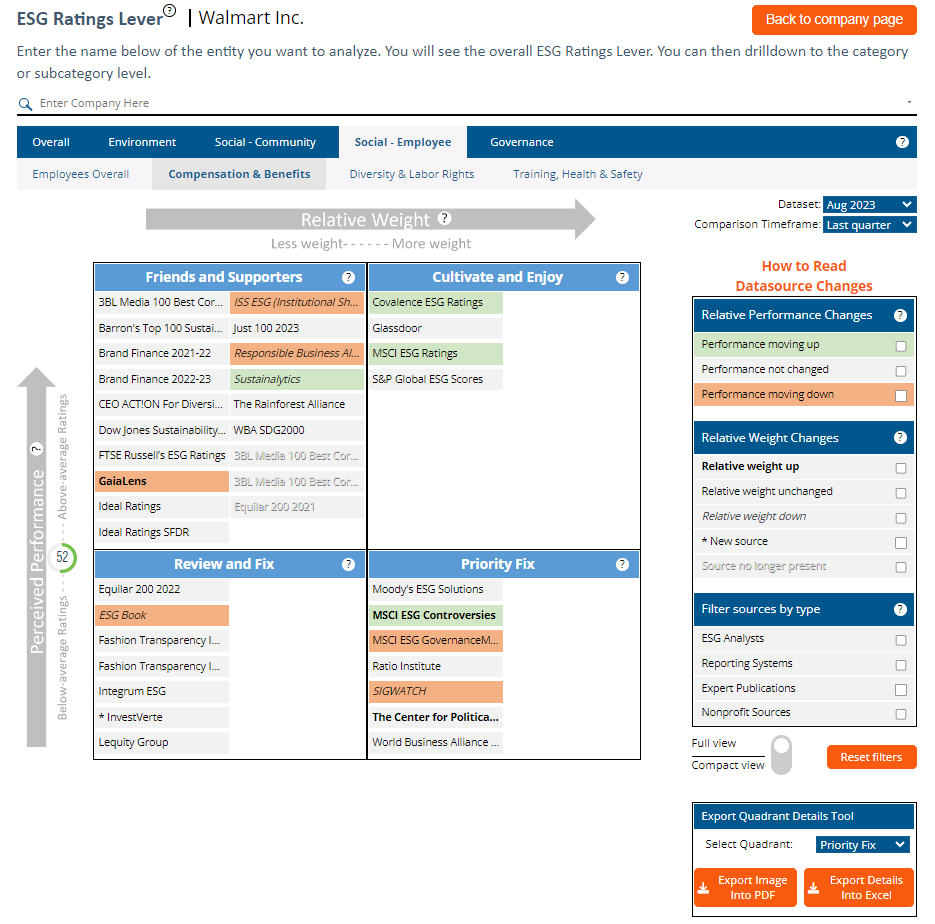

See Your Roadmap for

Company Ratings Improvement

with the new CSRHub ESG Ratings Lever below

We Harmonize Global ESG Data

Your title or message

![Some Image]()

Sources

{{sources_count}}

for

Companies

{{companies_count}}

in

Countries

{{countries_count}}

Your title or message

![Some Image]()

Summary of the data sources currently reporting on JP Morgan Chase & Co. and some examples

ESG

Analysts

{{ esgAnalystsDatasources.length }}

Reporting

Systems

{{reportingSystemsDatasources.length}}

Expert

Publications

{{ expertPublicationDatasources.length }}

Nonprofit

Sources

{{nonprofitDatasources.length }}

How to Get Our Data

Website Browsing

Excel Dashboards

-->

RESTful API

Distributors and Integrators

Explore Your Options

Schedule a consultation with a CSRHub team member to

explore your use case and discuss a tailored solution.

Name Variants for JP Morgan Chase & Co.