You've reached the limit for free Overall Ranking scores. For more information, request a demo.

See CSRHub in Action

You have a total of 10 free searches available.

Corporate Social Responsibility (CSR) & Environment, Social, Governance (ESG) Metrics

Vale ESG Ranking

ESG Ranking (%)

?

38

Sources

?

No Special Issues

Affect This Company

?

38

Sources

?

No Special Issues

Affect This Company

?

Vale, formerly known as Companhia Vale do Rio Doce, is a global company headquartered in Brazil, with a workforce of over 100,000 employees, including outsourced workers. It is principally engaged in the mining of minerals for various applications, including appliances, electronic equipment, cars, computers and construction materials. Mined materials include iron, nickel, coal, aluminum, potassium, copper, manganese, kaolin and steel. The company also engages in energy generation for its operations and transportation & logistics.

Name changed from Companhia Vale do Rio Doce - CVRD in 2007

Who Uses CSRHub and How

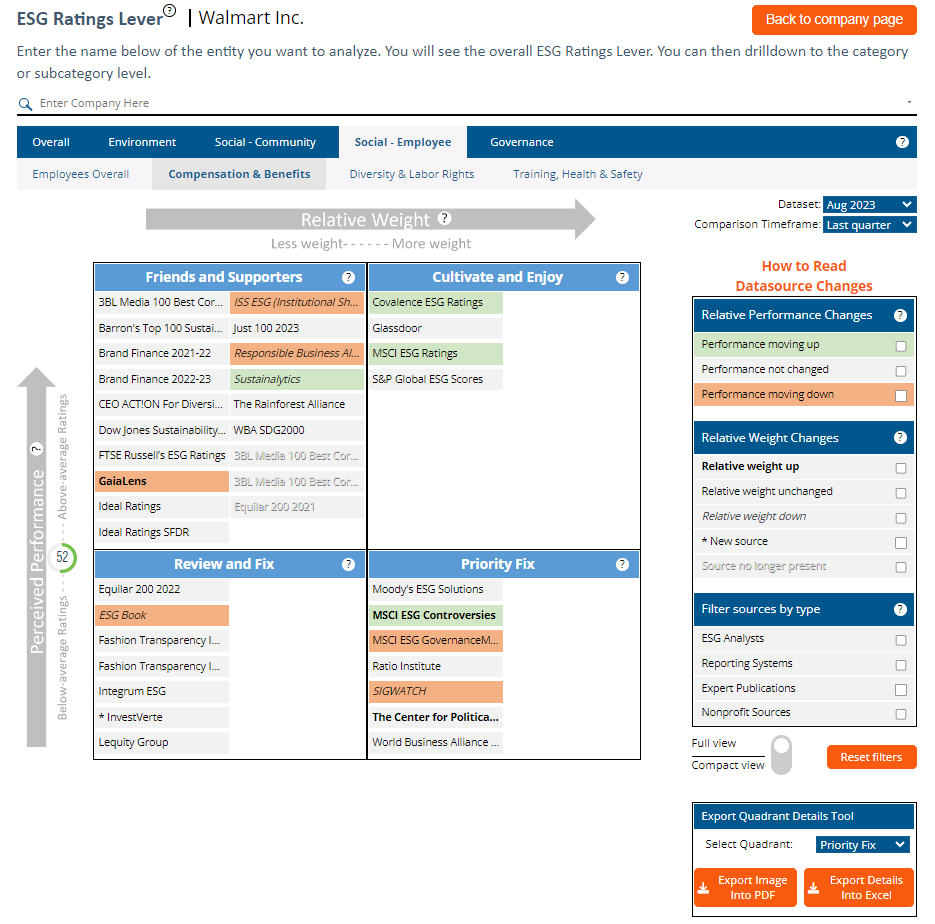

Companies face a complex ESG landscape with many raters and little coherence.

Corporate Managers

Benchmark against your peers

Improve stakeholder communication

Pinpoint ESG reporting gaps

Review your supply chain

Uncover ESG business opportunities

Consultants

Expand your ESG expertise

Find and focus on the best reporting strategy

Propose innovations and drive change

Communicate with all levels of management

Build client ESG knowledge

Supply Chain Professionals

Rapidly review your supply chain

Proactively identify and address risk

Assess and improve supplier performance

Access easy-to-use tools to fit into your management system

Investment Professionals

Screen your investment universe

Back test to find material ESG indicators

Share your ESG strategy with clients

Engage with companies

Improve asset owner reporting

CSRHub includes data on environmental management, ERM, ESG, ESG ratings, business investment, and socially responsible companies.

See Your Roadmap for

with the new CSRHub ESG Ratings Lever below

We Harmonize Global ESG Data

Your title or message

Sources

{{sources_count}}

for

Companies

{{companies_count}}

in

Countries

{{countries_count}}

Your title or message

Prev

Next

Summary of the data sources currently reporting on Vale and some examples

ESG

{{ esgAnalystsDatasources.length }}

Reporting

{{reportingSystemsDatasources.length}}

Expert

{{ expertPublicationDatasources.length }}

Nonprofit

{{nonprofitDatasources.length }}

How to Get Our Data

Website Browsing

Excel Dashboards

-->

RESTful API

Distributors and Integrators

Explore Your Options

Schedule a consultation with a CSRHub team member to

explore your use case and discuss a tailored solution.